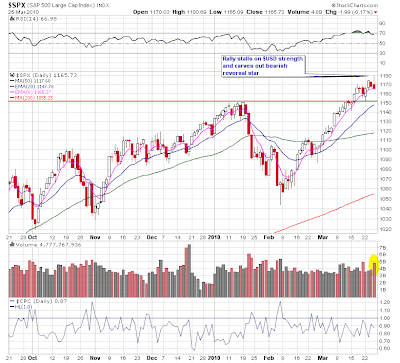

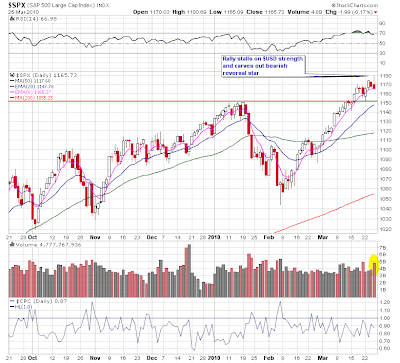

The chatter in

pre-market was that the market was anticipating good jobs data next week and would likely continue to rally into those numbers. The first half of the session supported that idea, but early afternoon was hampered by another weak auction and more headlines out of Europe regarding aid to Greece which popped the greenback and melted the markets. At the end of day we have a lot of shooting stars and bearing engulfing sticks.

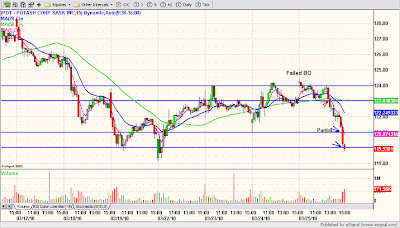

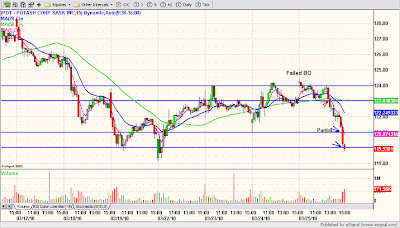

POT attempted to BO of a solid base on the open but faltered. This was followed by choppy trade and a series of lower highs and lower lows, eventually setting a low risk short on the 5 minute

timeframe below.

The chatter in pre-market was that the market was anticipating good jobs data next week and would likely continue to rally into those numbers. The first half of the session supported that idea, but early afternoon was hampered by another weak auction and more headlines out of Europe regarding aid to Greece which popped the greenback and melted the markets. At the end of day we have a lot of shooting stars and bearing engulfing sticks.

The chatter in pre-market was that the market was anticipating good jobs data next week and would likely continue to rally into those numbers. The first half of the session supported that idea, but early afternoon was hampered by another weak auction and more headlines out of Europe regarding aid to Greece which popped the greenback and melted the markets. At the end of day we have a lot of shooting stars and bearing engulfing sticks.

POT attempted to BO of a solid base on the open but faltered. This was followed by choppy trade and a series of lower highs and lower lows, eventually setting a low risk short on the 5 minute timeframe below.

POT attempted to BO of a solid base on the open but faltered. This was followed by choppy trade and a series of lower highs and lower lows, eventually setting a low risk short on the 5 minute timeframe below.

3 comments:

The SPX has been setting new highs along with the dollar. Today's reversal had very little to do with the dollar and everything to do with the fact that Treasury yields just broke higher. Look at a chart of $TNX and notice the 22bp spike in the yield out of a consolidation triangle. There is your culprit.

Jamie,

Nice trade in POT. Where was your initial stop loss in POT? Any guidelines you follow for drawing the S&R lines? You tend to use them VERY effectively.

New financial world http://WSJr.nl

Post a Comment