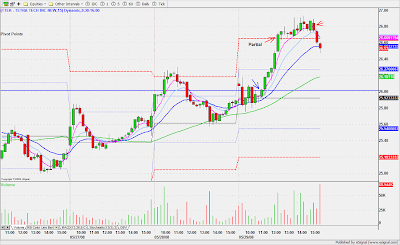

The first chart is a daily of SINA. Resistance at $53.00 based on yesterday's close. I was looking to target trade this one to resistance if it set up a B&B at or near $52.00. Worked out perfectly. Got the idea from HCPG based on their assessment of SOHU last night.

The first chart is a daily of SINA. Resistance at $53.00 based on yesterday's close. I was looking to target trade this one to resistance if it set up a B&B at or near $52.00. Worked out perfectly. Got the idea from HCPG based on their assessment of SOHU last night.The second trade was based on support of R2 and potential run to $54.00.

TTEK - Much better today than yesterday.

TTEK - Much better today than yesterday. Steel sector was sort of split, so I guess I should avoid trading the leader when all the rest is so choppy, unless there's a story. I had plenty of opportunities to scratch the trade. If they don't take off right away, that's usually the best thing to do. Because the shooting star (BO bar) closed green, I hung on.

Steel sector was sort of split, so I guess I should avoid trading the leader when all the rest is so choppy, unless there's a story. I had plenty of opportunities to scratch the trade. If they don't take off right away, that's usually the best thing to do. Because the shooting star (BO bar) closed green, I hung on.

7 comments:

Hey Jamie, I am unfamiliar with the term "target trade".

It's not a price point at which to buy (like a B&B), correct? Is this an area to exit (assumming you are already in the trade)?

Cool trade with SINA!

I have a question regarding your eSignal setup (posted yesterday). On the left side you have a number of sector stocks. My question is:

1. How do your determine which stocks to put there?

2. Do you always watch the same sectors or do you rotate them based on market activity?

Thanks in advance!

anarco

PDT,

Target trading is an intraday base that sets up usually 1 pt. above/below the daily base (support/resistance line). Something I learned from the High Chart Patterns membership. On the SINA chart I saw daily resistance at $53.00 from May 21 and 22. When it set up a B&B at exactly $52.00 I took the trade to the target knowing it would stop at resistance and retrace before moving higher.

Thanks Anarco,

Most of the sectors and stocks within are a collection of HCPG trading lists. Also a while back they gave us lists of their favorite stocks to put in each sector. Plus a few of my personal favorites from the WL as well. Some of the quote windows are hidden behind the ones you see on the screen. I listed the sectors in the comments of the previous post.

Jamie,

As usual thanks for your fine accounting of the trades. The school sector: dv esi apol coco ceco uti stra coco cpla schl took off at the open..better gdp? also ma v. I had ma @40 but sold. V????? Long term ?? Brand name?

BL,

MA price target increased at Keybanc this morning. Don't know about V. Think the earnings were a bit of a disappointment. Maybe wait for the credit crunch to ease somewhat.

Jamie,

Interesting screen: >$2 5-15 min after the open. BTW, last 10 yrs first day of mo avg DOW gain +42 pts vs ALL other days -.37....institutions. Quarterly first days of first month are even better(Jan Apr Jul, Oct[ a bit different])

Post a Comment