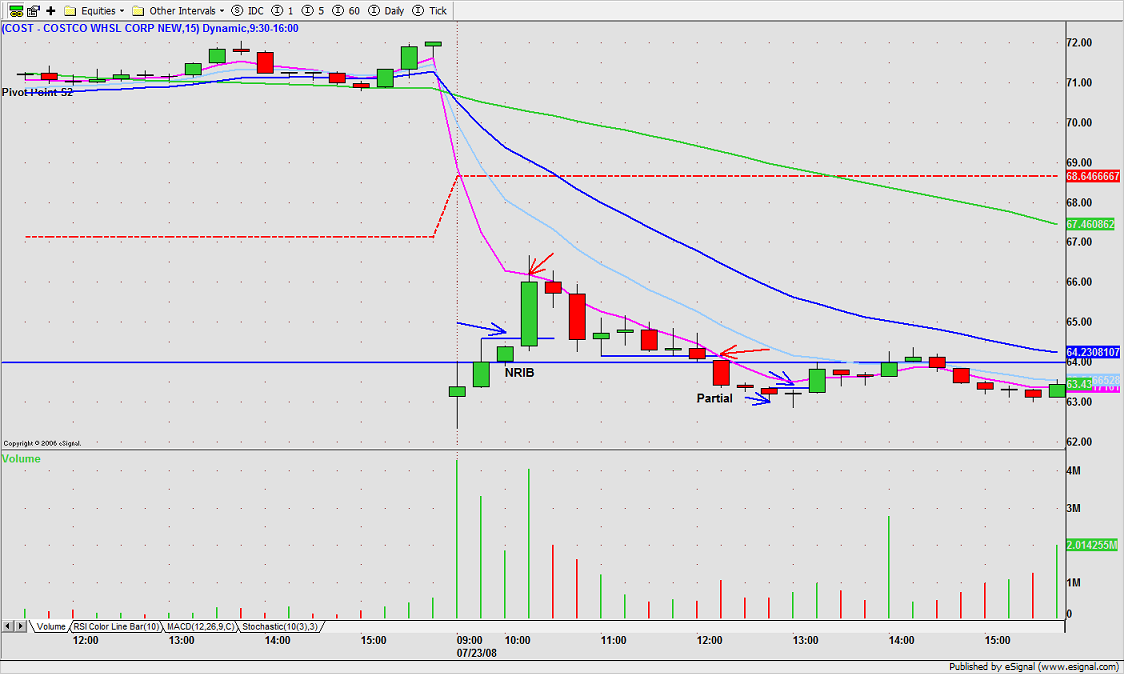

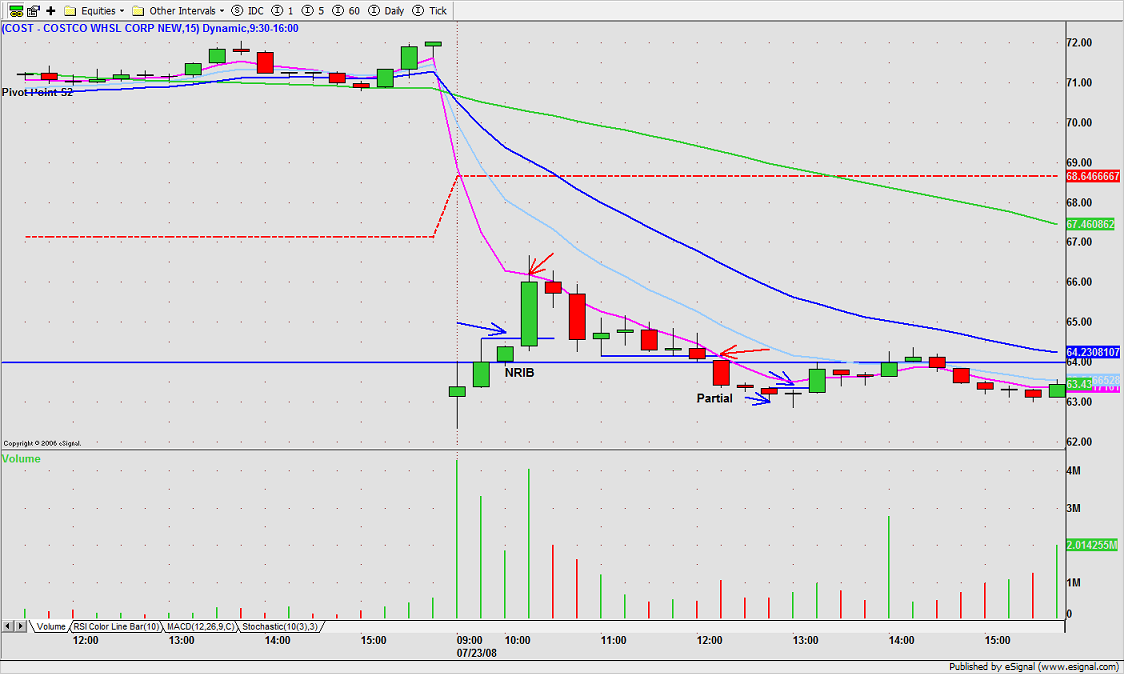

COST had a lot of momentum in

pre-market. I actually wanted to short it as it based at $64.60 in

pre-market, but due to technical problems, I missed the trade. I did manage two low risk trades once the session got underway. The first was a long entry off of a 3 pivot point base on the 1 min.

time frame which quickly reversed, but allowed for some fast money. This was attempt to fade the gap, but was rejected at the down sloping 5 period EMA on the 15 minute

time frame. The second entry, also a 3 PP base, was on the short side. It generated just over 1 pt. before reversing.

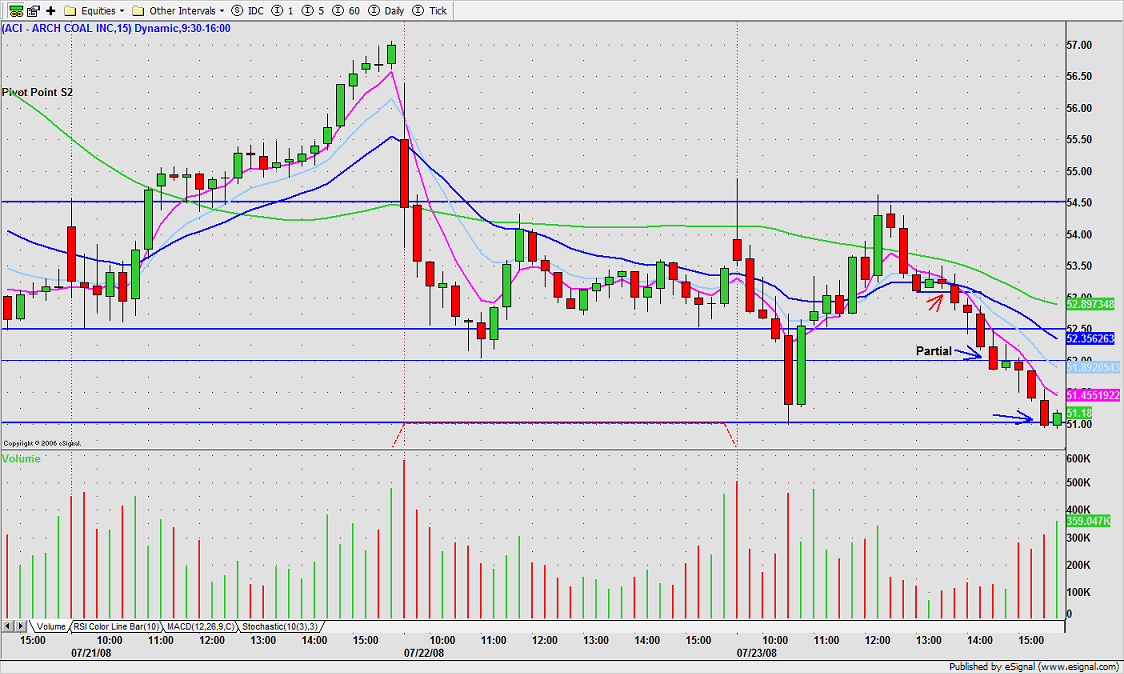

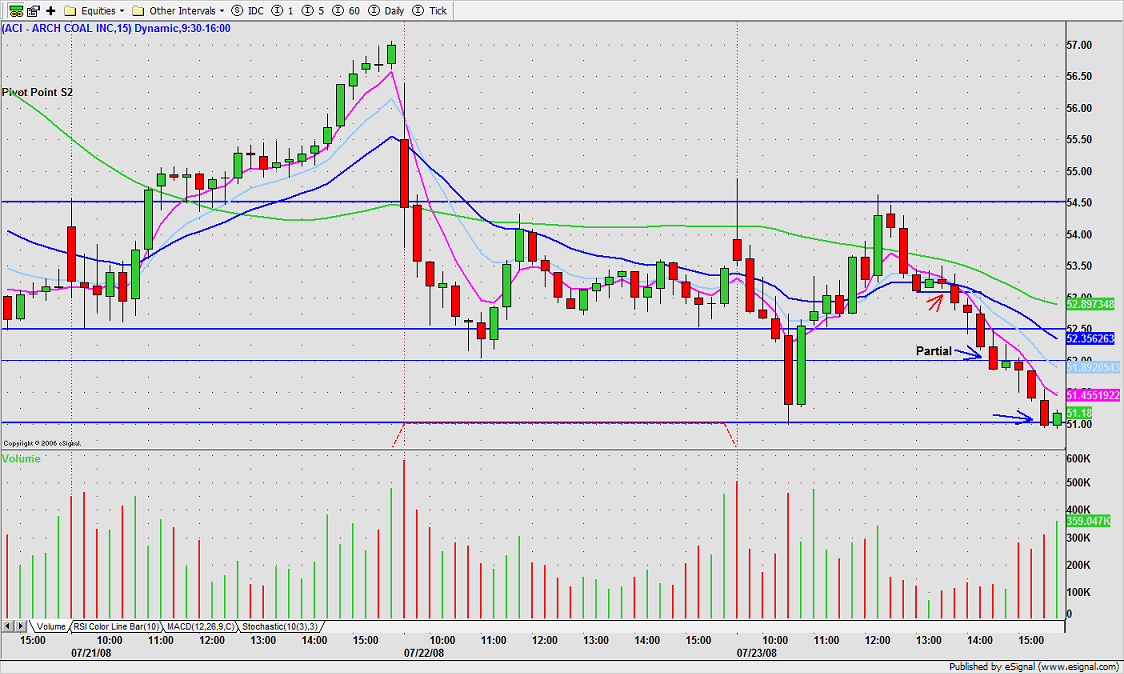

ACI

ACI tested resistance on the open and swooned lower. Following a full

retracement back to resistance, it carved out a bearish star-like reversal pattern. After consolidating sideways in a narrow range on low volume, and with a little help from the FED, it swooned again, closing near its lows.

COST had a lot of momentum in pre-market. I actually wanted to short it as it based at $64.60 in pre-market, but due to technical problems, I missed the trade. I did manage two low risk trades once the session got underway. The first was a long entry off of a 3 pivot point base on the 1 min. time frame which quickly reversed, but allowed for some fast money. This was attempt to fade the gap, but was rejected at the down sloping 5 period EMA on the 15 minute time frame. The second entry, also a 3 PP base, was on the short side. It generated just over 1 pt. before reversing.

COST had a lot of momentum in pre-market. I actually wanted to short it as it based at $64.60 in pre-market, but due to technical problems, I missed the trade. I did manage two low risk trades once the session got underway. The first was a long entry off of a 3 pivot point base on the 1 min. time frame which quickly reversed, but allowed for some fast money. This was attempt to fade the gap, but was rejected at the down sloping 5 period EMA on the 15 minute time frame. The second entry, also a 3 PP base, was on the short side. It generated just over 1 pt. before reversing.

ACI tested resistance on the open and swooned lower. Following a full retracement back to resistance, it carved out a bearish star-like reversal pattern. After consolidating sideways in a narrow range on low volume, and with a little help from the FED, it swooned again, closing near its lows.

ACI tested resistance on the open and swooned lower. Following a full retracement back to resistance, it carved out a bearish star-like reversal pattern. After consolidating sideways in a narrow range on low volume, and with a little help from the FED, it swooned again, closing near its lows.

6 comments:

Nice Jamie. We both took the same Costco trade (the first one). It happened early enough in the day for me to take advantage :)

Hey Jamie,

Good job in a fairly tough market. I am not doing much trading these days and may not for the couple of weeks. It was taking too much time/effort to manage trades of late.

In hindsight, I have been seeing mirror reversal patterns (same day) in many of my WL stocks. For example, see the morning and then mid-day (trade you took) mirror patterns in ACI (about the 53.15 pivot). They look like mirror H&Ss or mirror cup & handles.

Hey Dave,

Yeah, that was a nice, fast trade. Some of these gappers offer good trading opps the following day. MICC, my gapper from yesterday, had almost a full retracement to yesterday's ORH. I missed it, but it was an easy B&B on the lower timeframe. So keep COST on the trading list for tomorrow.

Hey Jim,

Agree the trading environment is tricky. It's hard to know when to get in and out because everything pivots and reverses for a full retrace for no obvious reason. I have so many S/R lines and trend lines on some of my WL stocks that I can't see the forest for the trees.

Very nice as usual.

Would you consider FNM to a good candidate for a 3 PP at $14.75? It had nice lower highs on each bounce but there wasn't much follow through.

Thanks!

Hey PDT,

The best candidates form a base at or near the ORH for longs and ORL for shorts. These bases usually take a couple of hours to form. So the longer the base, the better the extension, all things being equal.

This morning I had WLP and UNH (sympathy) as gappers on WLP earnings. But they didn't do much. AET another sympathy play, is a really good example of a 3PP base forming after a gap up.

Unfortunately, FNM has gotten a head of itself and may need to consolidate a bit here.

Post a Comment