There wasn't much happening on the merger front so the usual Monday catalysts were absent resulting in a lacklustre session on much reduced volume. Most of my trading today was focused on intraday pivot points with small moves within narrow ranges except, of course for AAPL.

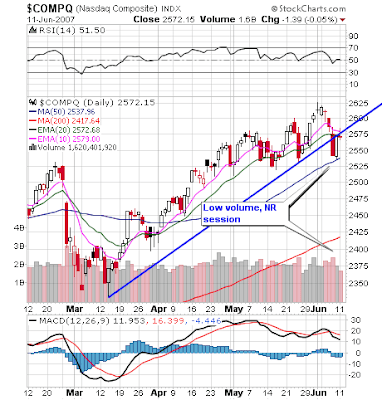

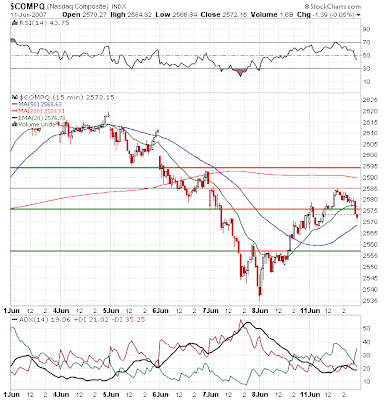

There wasn't much happening on the merger front so the usual Monday catalysts were absent resulting in a lacklustre session on much reduced volume. Most of my trading today was focused on intraday pivot points with small moves within narrow ranges except, of course for AAPL.I won't over analyze today's session except to say that after Thursday's fall and Friday's strong rebound, it is normal to have some sideways action. I'm watching to see if we can manage to hold the next lower PP on the 15 chart above and then bounce from there.

Companies moving in after hours trading in reaction to earnings: Trading Up: JMBA +8.3; CNLG +5.5%; TTWO +1.5%... Trading Down: SORC -1.6%; LLUB -1.2%; XIDE -1.2%... Companies moving in reaction to news: Trading Up: ADAT +7.9% (says Pacific Pulmonary Services to adopt it's Inscrybe healthcare platform); AOI +4.7% (announces restatement of first three quarters of FY07); COLY +1.1% (announced it has entered into an agreement with 3M to acquire the majority of their therapeutic Toll-like receptor cancer programs)... Trading Down: ACLI -13.8% (lowers guidance for FY07; announces $200 mln buyback); TXN -2.1% (narrows EPS & revenue guidance range for Q2); NRGN -1.5% (proprietary insomnia compound data presented at Associated Professional Sleep Societies annual meeting); MCGC -1.1% (sells Superior Publishing for $65 mln).

Watch List: AMZN - I'm looking for a shorting opp as AMZN sets up to test gap support between $70.88 and $70.41. The next major PP support is $67.70. Minor support at $70 and $69.00

2 comments:

AMZN is weak, I scalped it short yesterday a bunch. I am short pre-market half size at 70.53, let's rock.

Glenn,

I was contemplating shorting AMZN in pre-market but worried that it might attempt a gap fill on the open. Glad it worked out for you!

Post a Comment