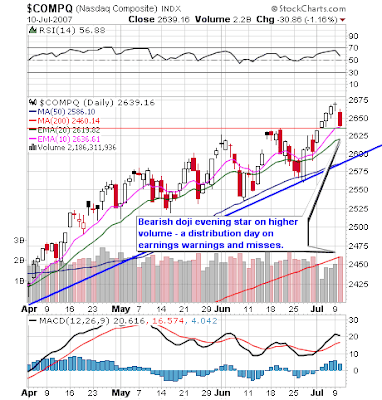

As mentioned last night, a lower open and close would generate a bearish doji evening star and that's exactly what happened after some earnings weakness and a warning from Sears (NASDAQ:SHLD). The day's broad based selling occurred on higher volume which constitutes a distribution day. Despite the WR red bar, the NASDAQ closed above the breakout point. We'll see if that sliver of bullish gap support will hold tomorrow.

As mentioned last night, a lower open and close would generate a bearish doji evening star and that's exactly what happened after some earnings weakness and a warning from Sears (NASDAQ:SHLD). The day's broad based selling occurred on higher volume which constitutes a distribution day. Despite the WR red bar, the NASDAQ closed above the breakout point. We'll see if that sliver of bullish gap support will hold tomorrow.Economic calendar: Crude inventories at 10:30

Companies moving in after hours trading in reaction to earnings: Trading Up: INNO +14.4%; CCF +6.4%; VOXX +2.8%; VSGN +2.8; ZZ +1.2%... Companies moving in reaction to news: Trading Up: TRCA +22.9% (announces agreement with Genentech for worldwide growth hormone and IGF-1 combination product development and commercialization); ZILA +8.3% (Executive and Board Chairman acquire stock); SGMO +7.6% (Sigma-Aldrich and Sangamo BioSciences announce alliance to develop zinc finger-based laboratory research reagents); SRDX +2.2% (and Paragon Intellectual Properties to collaborate on FINALE coated prohealing stent to combat late stent thrombosis); GMTN +2.1% (wins major legal victory); BRNC +1.9% (announces monthly operating results); NEST +1.7% (executes new public safety contract with the City of San Juan Capistrano, California); SJR +1.2% (announces stock split approval); NAVR +1.0% (Encore Software, wholly owned subsidiary of NAVR, signs agreement with Sony Online Entertainment); SMDI +1.0% (guides 1Q08 below consensus; announces resignation of President and Chief Operating Officer of Products Hank Jallos); MDU +1.0% (closes sale of domestic IPP companies)... Trading Down: VTAL -23.7% (guides below consenuss for Q2 & FY07); CPWR -17.2% (expects 1Q08 revs of $278 mln (consensus $301.57), sees EPS breakeven (consensus $0.11); CPKI -1.1% (reports preliminary results for Q2 generally in-line).

2 comments:

jamie,

have you ever noticed that when the adx line gets above both the dm lines, a reversal usually occurs?

bid

Good observation Bid! That's the case this morning. We got some support from the gap and bounced.

Maybe a dead cat bounce?

Post a Comment