With all the headlines (LEH, MER BAC, AIG), I found today's markets were jittery and choppy so I stuck to the most orderly setups. AIG was a wide gap so I was looking for confirmation on the 1 minute time frame (3 pivot point base & break).

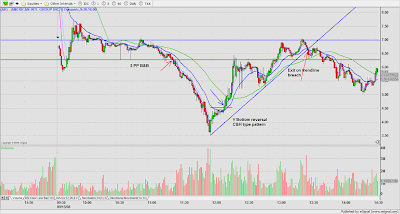

With all the headlines (LEH, MER BAC, AIG), I found today's markets were jittery and choppy so I stuck to the most orderly setups. AIG was a wide gap so I was looking for confirmation on the 1 minute time frame (3 pivot point base & break).After a fast move to the downside and capitulation volume, it carved out a V bottom with handle for a low risk long.

DRYS was a low risk short on price/volume contraction at the base $50.70. Partial after 3WRBs and 38% Fib. extension of the previous day high to the ORL. A whip lash reversal resulted in a stop out with slippage on the balance of the trade. My Esignal platform was unstable most of the day, so I was caught in a dead screen, otherwise, I might have been able to anticipate and get a better exit on the second half.

DRYS was a low risk short on price/volume contraction at the base $50.70. Partial after 3WRBs and 38% Fib. extension of the previous day high to the ORL. A whip lash reversal resulted in a stop out with slippage on the balance of the trade. My Esignal platform was unstable most of the day, so I was caught in a dead screen, otherwise, I might have been able to anticipate and get a better exit on the second half.

3 comments:

Jamie,

Great trades. I really like the round trip in AIG. Unbelievable!

Tyler

Hi Jamie,

On your AIG 1st trade, wonder why you didn't exit when it tagged your PP afew times and failed to clear it? Thanks

YR

Thanks Tyler.

YR,

I think you mean the 2nd AIG trade. Normally, I would have closed the long entry on the retracement back to the base, but I had technical problems with Esignal all day as my screens kept freezing up on me. So when that happens, I have to power down and restart.

Post a Comment