Sort the WL on % change. Review sorted list. Gold and commodities rise to the top spots. Find charts that look promising and stick with them. Eventually a trade will develop. Here are a few trades. ABX is a basic C&H base & break with a target of 100% (measured move of a chart pattern is 100% from the bottom of the pattern to the BO point). A slow mover but eventually reached the target.

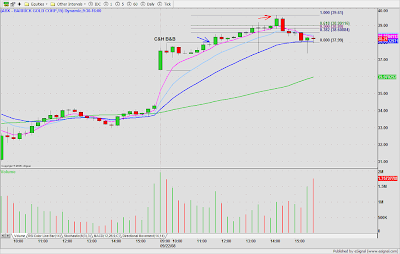

Sort the WL on % change. Review sorted list. Gold and commodities rise to the top spots. Find charts that look promising and stick with them. Eventually a trade will develop. Here are a few trades. ABX is a basic C&H base & break with a target of 100% (measured move of a chart pattern is 100% from the bottom of the pattern to the BO point). A slow mover but eventually reached the target.ACI offered a quick scalp out of the OR consolidation. I should have exited after 3 WRBs, but I slipped up. It's easier to get out on strength. The second trade was a simple Fib. retracement from Friday's late day swing low to today's early swing high. A normal retracement is 38%. If price sets up a low risk entry at, or near that level, enter the trade. If the setup looks weak, wait for a base to form (upper blue line segment).

No comments:

Post a Comment