Marginally disappointing initial claims figures gave the bears the edge in pre-market. A 62% retracement of the early slide was ambushed and the S&P emini futures extended a full measured move in 30 minutes of fast selling. After the midday chop, no follow through occurred as participants were cautious ahead of tomorrow's jobs data.

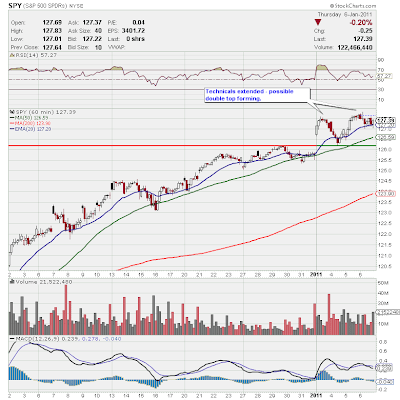

Marginally disappointing initial claims figures gave the bears the edge in pre-market. A 62% retracement of the early slide was ambushed and the S&P emini futures extended a full measured move in 30 minutes of fast selling. After the midday chop, no follow through occurred as participants were cautious ahead of tomorrow's jobs data.On the 60 minute chart of the SPY we see a double topping pattern taking shape. If the pattern breaks down, we could see some fast selling. On the daily (not depicted) we have two red hanging men, which, if confirmed, could be very bearish short-term.

No comments:

Post a Comment