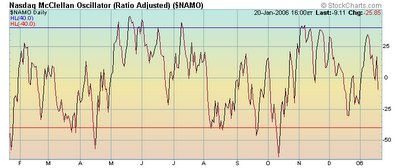

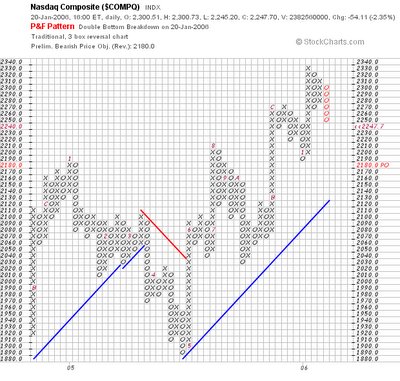

Wow, what an ugly chart. Trader Mike was right, yesterday's action was a dead cat bounce. Today's outcome was decisively bearish and supported by high volume (2.4 billion shares). The P&F chart is now indicating a bearish reversal is in play with a preliminary target of 2180 which would bring us 10 points lower than the January low and break the trend line. The extension of the rounded top formation, which I now see clearly, is usually quite brutal. The Nasdaq closed on its lows and is sitting on its 50 period MA. Next week will be interesting.

GOOG gave back $37 today. I rarely look at the GOOG chart because its lofty price keeps it out of my repertoire of potential trades. However, when I heard Maria Bartiromo talk about it on CNBC this afternoon, I decided to have a look. I noticed that the GOOG chart also has a rounded top with the addition of a falling window pattern (same as discuused for AAPL here yesterday). It looks like some of 2005's winners could get a bad start in 2006.

No comments:

Post a Comment