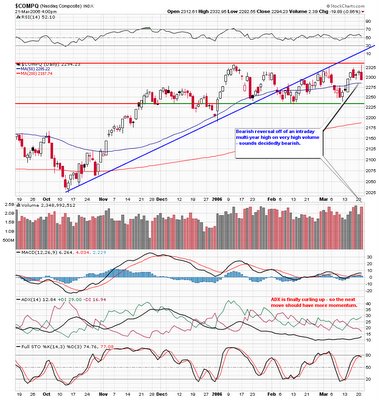

The Nasdaq actually hit its January high of 2332.92 during today's session but had a very bearish reversal in the afternoon. The SOX led the Nasdaq rally this morning, but after hitting an intraday multi-year high, the market reversed on heavy afternoon selling with no bounce into the close. The after-market was also negative and making matters worse was Microsoft's anouncement that the Vista operating system would not be available to consumers in 2006 as planned. The worst performing tech sector was the NBI (biotech) which fell sharply off the open, bounced back and then cratered again in the afternoon, carving out a wide range red bar. The Nasdaq finished the day with a red bar and high upper shadow. Combined with yesterday's spinning top, we appear to have a bearish evening star pattern. The 60 minute view shows that we closed on support, but that won't likely hold. Next level of support is 2280. NDX futures are down 11 points in after hours. Today's big NDX winner was NVDA and the three biggest losers were BMET, CELG, and AAPL. Based on today's high, the P&F chart has extended the price target to 2520 so I am posting the chart here, but this could change quickly if the market remains bearish.

No comments:

Post a Comment