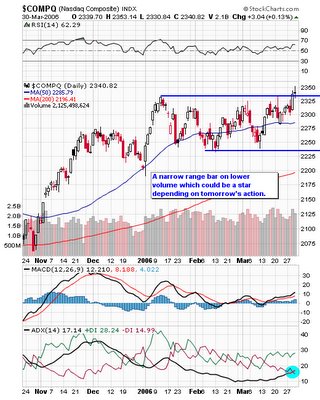

Not surprisingly, the market didn't give us much follow through after yesterday's quarter-end window dressing. The Nasdaq added just three points on lower volume and carved out what could be a star with shadows at both ends. The SOX and internets were weak, while hardware added to yesterday's gains. The advance just stalled at 10:00, came back in and the rest of the day was narrow range. The INDU meanwhile, carved out a bearish engulfing bar, but managed to close above support.

Not surprisingly, the market didn't give us much follow through after yesterday's quarter-end window dressing. The Nasdaq added just three points on lower volume and carved out what could be a star with shadows at both ends. The SOX and internets were weak, while hardware added to yesterday's gains. The advance just stalled at 10:00, came back in and the rest of the day was narrow range. The INDU meanwhile, carved out a bearish engulfing bar, but managed to close above support.

2 comments:

Hi Jamie,

Not sure if u had chance to look at my following post which I posted few days back.

I had few questions about the trading site "http://www.interactivebrokers.com" which u use for trading I believe. I was very confused about few items on the site and wanted to clarify from someone who is using it before I open an account as I am US resident.

1. Is there any minimum account balance u need to maintain to avoid any fees?

2. Any Inactivity Fee?

3. Day trading restrictions as I saw something mentioned...

http://www.interactivebrokers.com/en/trading/marginRequirements/patternDayTraders.php?ib_entity=llc

4. How much does it cost usually to tarde options?

The reason I am asking all such questions is cause I usually trade with 5-10K capital and not sure if it wil be beneficial to open that account as it says monthly fees etc..... :(

You helps will be appreciated. Thank you in advance :)

Regards

isitpossible@gmail.com

Sorry for the delay, but I am behind in answering my email.

I don't know the answers to all of your questions because I only trade stocks, but I will tell you what I know. In order to day trade U.S. stocks you must maintain an account above $25,000.00 USD. A pattern day trader is defined by the Nasdaq as someone who trades more than three times per week. So if you plan to trade with $5-10k capital you won't be able to buy stocks more than three times per week. However, you will be able to trade Emini futures (options I'm not 100% sure but most likely yes). There are minimal fees in the range of $10-20 per month if you don't meet the minimum transaction requirement which is 10 for stocks. IB is best known for its Options platform and their commissions are cheap. They make their money on volume and of course they get money from the market makers for order flow.

Post a Comment