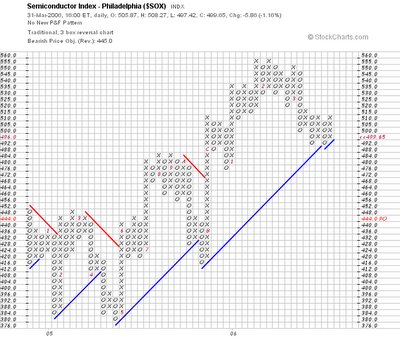

Currently we have a P&F target of 445 for the SOX, however, we've had a pattern of steep rallies off of these types of pullbacks in the past year. This should resolve itself in the near-term.

Currently we have a P&F target of 445 for the SOX, however, we've had a pattern of steep rallies off of these types of pullbacks in the past year. This should resolve itself in the near-term. SOX sector weakness has been plagued by an inability to break the 20 day EMA and 508 resistance on a closing basis for almost three weeks.

SOX sector weakness has been plagued by an inability to break the 20 day EMA and 508 resistance on a closing basis for almost three weeks.Pockets of Strength NVDA, OVTI, ZRAN - Names with a Rising ADX LINE

The Yahoo message board for NVDA was buzzing with a message entitled " NVDA Now on TOP Short List". As it turns out Scott Sullivan of Briefing.com has a special feature for Active Traders where he posts scan results for the following trading day and he indicated that NVDA had staged a false breakout on Friday and was ripe for shorting. I wonder if he is shorting NVDA with his own capital. As far as I can see NVDA followed the market on Friday and is in the process of consolidating its recent gains. On a Fibonacci retracement basis, it is unlikely that NVDA will pullback much below $55.00 and it could just continue to move sideways until it's ready to move higher. Shorting strong stocks is not part of my game plan. I don't like getting squeezed.

The Yahoo message board for NVDA was buzzing with a message entitled " NVDA Now on TOP Short List". As it turns out Scott Sullivan of Briefing.com has a special feature for Active Traders where he posts scan results for the following trading day and he indicated that NVDA had staged a false breakout on Friday and was ripe for shorting. I wonder if he is shorting NVDA with his own capital. As far as I can see NVDA followed the market on Friday and is in the process of consolidating its recent gains. On a Fibonacci retracement basis, it is unlikely that NVDA will pullback much below $55.00 and it could just continue to move sideways until it's ready to move higher. Shorting strong stocks is not part of my game plan. I don't like getting squeezed. OVTI is consolidating recent gains and could move higher anytime. Buy on a break of the consolidation high.

OVTI is consolidating recent gains and could move higher anytime. Buy on a break of the consolidation high. ZRAN looks like it is forming an ascending triangle.

ZRAN looks like it is forming an ascending triangle.Extreme ADX Readings Despite Prices That Have Rallied off of Recent Lows - CYMI, LRCX, SNDK - This type of divergence usually precedes explosive price moves.

Watch CYMI for a close above its downsloping tendline.

Watch CYMI for a close above its downsloping tendline. LRCX has made a series of higher lows as it observes the support of it rising trendline. A close above its 50 day MA would be very bullish.

LRCX has made a series of higher lows as it observes the support of it rising trendline. A close above its 50 day MA would be very bullish. SNDK is a little harder to read, but keep it on your radar as it may surprise us with some follow through shortly.

SNDK is a little harder to read, but keep it on your radar as it may surprise us with some follow through shortly.ADX Pauses (Flattens) after Recent Strength - CREE and PMCS - A pullback to the rising 20 day MA is likely for these two names.

BRCM looks like it will stage a turnaround in the very near term.

BRCM looks like it will stage a turnaround in the very near term.

No comments:

Post a Comment