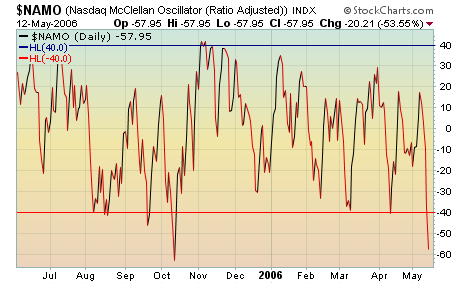

Continuing dollar weakness and interest rate concerns sent the markets down amid high volume (institutional selling) again today. The small caps and technology continued their leadership role in the fall. The Nasdaq gapped down on the open and continued lower, closing on its lows. Internet stocks were particularly weak vs. the SOX which seems to be stablizing on the support of its 200 day MA after a full week of heavy selling. The Nasdaq is closing in on its 200 day MA and we may get a break from all the selling early next week. From the P&F chart above we see that we have a new lower target of 2140, from the current level of 2244, that's another 100 pts. The McClellan oscillator is testing oversold levels set back in October of last year. Today's big NDX losers were EXPE, NVDA, and JOYG and the winners were ADSK, RIMM, and CSCO.

No comments:

Post a Comment