A promising open turned into lacklustre consolidation session until Fed-speak - Richmond's Lacker stated that the Fed's planned rate hike pause was questionable. This sent the markets into a nose dive for the balance of the session resulting in another wide range bearish stick on lower volume. Despite all that, disk drive closed strong and hardware had a second sesion in the green. Biotechs led the way down.

A promising open turned into lacklustre consolidation session until Fed-speak - Richmond's Lacker stated that the Fed's planned rate hike pause was questionable. This sent the markets into a nose dive for the balance of the session resulting in another wide range bearish stick on lower volume. Despite all that, disk drive closed strong and hardware had a second sesion in the green. Biotechs led the way down.The AH session was also very interesting with DELL and MRVL reporting and trading up in AH. DELL's annoucement regarding optional processors for DELL servers by year-end also gave a big boost to AMD which is up over 10% in AH. Needless to say, INTC is sinking deeper into the gutter.

In the last week and half, markets have been driven mainly by economic and geo-political data. Tomorrow's session has half a chance of being driven more by earnings and semiconductors could get a boost. However, tomorrow is also options expiration so volatility will be part of the package.

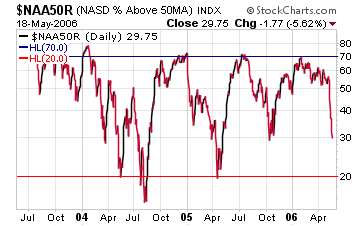

I noticed a few bloggers out with the percentage of S&P 500 stocks trading below their 50 MA. The chart above is the same thing for the INDX. As day traders we've felt the steepness of that relentless fall over the past week and half. But as the picture shows, this is not a pullback, its more like falling off a cliff.

No comments:

Post a Comment