The market tried to rally off of the slightly lower than expected PPI data this morning, but couldn't find any momentum and ended making a series of lower highs and finally slipped lower midday. Again, all major tech sectors ended the day in the red. Today's lower close took place on significantly higher volume which supports what I said last night, as we get deeper into this second wave of selling, bearish momentum could turn into panic selling.

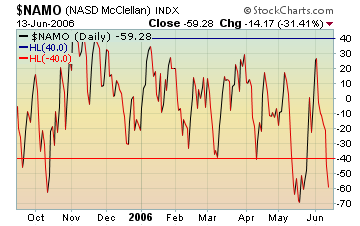

The market tried to rally off of the slightly lower than expected PPI data this morning, but couldn't find any momentum and ended making a series of lower highs and finally slipped lower midday. Again, all major tech sectors ended the day in the red. Today's lower close took place on significantly higher volume which supports what I said last night, as we get deeper into this second wave of selling, bearish momentum could turn into panic selling.I'm going to keep posting the NAMO (McClellan oscillator) and NAA50 (Nasdaq stocks above 50 MA) charts every night until we see a change in direction. Only 15% of NASDAQ stocks are trading above the all important 50 MA.

And if you think the American markets are having a rough ride, have a look below at how we fared today in Canada. The TSX is heavily weighted in oil, natural gas and commodities. We shed almost 300 pts or 2.6% and selling momentum, as measured by the ADX line, is accelerating.

2 comments:

It looked to me as if we had capitulation on commodoties today and equities are now poised for a short-term bounce.

Currently just long ERTS but am looking for stocks that will get a nice bounce off of a relief rally (probably stick with NVDA for one).

It's starting to feel that way, but I'm waiting for the markets to confirm. Commodities went parabolic on the upside and now they're doing the same on the downside. The $SOX is slowing down and a few names look like they could bounce here, including NVDA.

Post a Comment