The NASDAQ gapped down about 15 points on the open and headed south in a hurry. At the 10:00 reversal time it found support at 2060 and changed course, heading back up in an attempt to fill the opening gap. As soon as that target was achieved, the bears took back control for some heavy afternoon selling. The NASDAQ shed 36 points for a new closing low. We are quickly approaching the October lows and should find some support near 2025. The ADX line has signaled that the second wave of selling is underway.

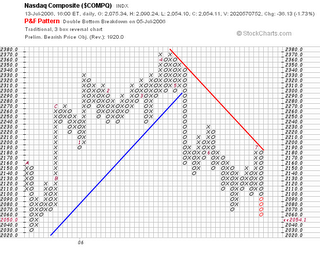

The NASDAQ gapped down about 15 points on the open and headed south in a hurry. At the 10:00 reversal time it found support at 2060 and changed course, heading back up in an attempt to fill the opening gap. As soon as that target was achieved, the bears took back control for some heavy afternoon selling. The NASDAQ shed 36 points for a new closing low. We are quickly approaching the October lows and should find some support near 2025. The ADX line has signaled that the second wave of selling is underway.The P&F chart above has a preliminary target of 1920.

The SPX:COMPQ chart shows that the last two selling waves produced reversals around these levels. However, it must be said that the last summer's dip was much more orderly than the current one.

2 comments:

Got any ideas for some more defensive plays in the current global climate? I'm looking to drop some losers in my 401k and move into something less risky that will be a good bet over the next few months until tech might be back in vogue later in the year.

What are the best energy plays that you see right now? My current energy plays are THE, ESLR, and PRNEX (not saying that they are that great, that's just what I happen to have in the sector at the moment).

My favorite energy play so far is ECA which is currntly trading in a channel. Buy between $45 and $46 and start taking profits at $52. My other plays are SU, CNQ, and possibly PEIX if it holds support at $20. These are all coming in right now so we'll have to patient until they find support.

I think the energy plays will be good given the current geo-politcal environment.

I'm still bullish TZOO unless it closes below $30.00. If it has a good earnings report next week, it could retest the April highs. However, I don't recommend it for a 401k, its too volatile.

Post a Comment