Stocks surged midday after Ben Bernanke made some encouraging remarks regarding interest rates and the need to refrain from further increases. However, the NASDAQ was already off to good start in the morning, but the Bernanke remarks gave it enough traction to easily take out recent highs. All major tech sectors participated in today's rally. NVDA and RIMM were the big NDX gainers. The losers encompassed satellite radio and BRCM and MRVL. Next levels of resistance are 2300, followed by 2325.

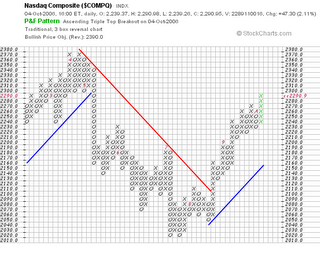

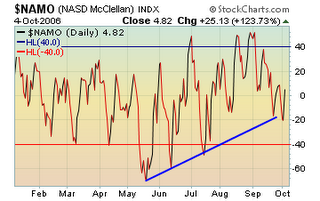

Stocks surged midday after Ben Bernanke made some encouraging remarks regarding interest rates and the need to refrain from further increases. However, the NASDAQ was already off to good start in the morning, but the Bernanke remarks gave it enough traction to easily take out recent highs. All major tech sectors participated in today's rally. NVDA and RIMM were the big NDX gainers. The losers encompassed satellite radio and BRCM and MRVL. Next levels of resistance are 2300, followed by 2325.On the economic calendar we have Initial Claims tomorrow at 8:30. According to the PF chart below, today marks a triple top breakout for the NASDAQ, with a target of 2390. The McClellan oscillator down below, surprisingly reads that we are neutral with respect to overbought (oversold) conditions. So rally on!

2 comments:

Hi Jamie,

How do u usually determine market sentiment for the day? Do u look at TRIN, TICK or other indicators? What if these indicators give conflicting reads?

If the market is bullish, would u take a short setup? Or u try to trade with the trend for the day? Thanks

The WHY-Trader

Hi WHY-Trader,

Sorry I'm not very sophisticated when it comes to market sentiment. My main read on the markets are the QQQQs. I look at price and volume, trend, support and resistance. I map everything out on my intraday charts the night before and try to trade with the trend.

For example, when the Qs took out the opening range on a huge uptick in volume this morning, it was time to get long.

Post a Comment