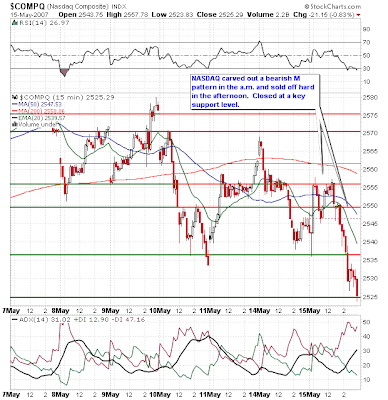

After yesterday's choppy session, the afternoon sell off was a welcome change in that it provided day traders with some direction. Things could get interesting as we come into our first real test of the April breakout point. Two distribution days over the last 5 sessions, puts the bears firmly in control.

After yesterday's choppy session, the afternoon sell off was a welcome change in that it provided day traders with some direction. Things could get interesting as we come into our first real test of the April breakout point. Two distribution days over the last 5 sessions, puts the bears firmly in control. Keep an eye on intraday pivot points as these will help you pick low risk entry points. Price often consolidates at the cusp of a pivot before making a big move.

Tomorrow's economic data is focused on Housing at 8:30; Industrial production and capacity utilization at 9:15 and crude at 10:30.

Companies moving in after hours trading in reaction to earnings: Trading Up: ERS +10.3%; PDEX +9.4%; PMRY +9.3%; CPWR +9.0%; CVLT +1.9%; SCR +1.5%; DTSI +1.4%... Trading Down: SLRY -21.6%; GOAM -13.0%; PFSW -7.7%; GPIC -6.7%; BLUE -6.7%; MSII -6.0%; SPIR -5.2%; FRPT -5.0%; FUEL -4.7%; AMAT -3.8%; PLAB -2.7%; HRBN -2.1%...

Companies moving in reaction to news: Trading Up: ACM +10.5% (announces closing of initial public offering); ASTI +4.3% (Paulson Capital discloses 11.5% stake in SC 13G filing); OVEN +1.8% (receives additional NASDAQ staff determination notice); OSTE +1.5% (expands tissue supply relationship with Community Tissue Services)... Trading Down: ESLR -3.8% (announces public offering of common stock of 15 mln shares); TPP -2.0% (prices $300 mln offering of junior subordinated notes); KMR -1.0% (announces public offering of listed shares). Courtesy of Briefing.com

No comments:

Post a Comment