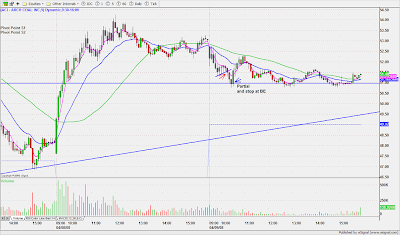

AMZN

AMZN, from the

WL breached its

trend line on the OR. The OR closed below the

trend line so I decided to short as soon as the OR was taken out. My stop was S1, partial at S2 and close at support (blue line). Sweet.

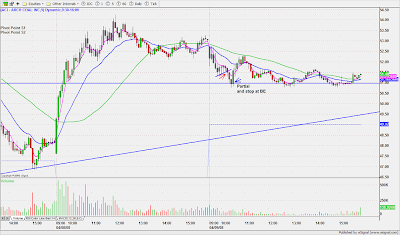

GARM

GARM took out yesterday's gap down support on the OR, but I was too busy with

AMZN. Luckily it found support at S2 and carved out a beautiful, dummy bear flag with 2 NRIBs (NR7 trigger bar). Partial out on breach of hammer high. Watch S2 for potential reversal. S2 holds on a closing basis. I had a target of $45.00 based on long term support. Close enough.

ACI

ACI won't go down. Dummy flag on 5 minute. Support at $51.00 breached but Crude inventories out at 10:30 were surprising on the low side triggering a swift reversal.

AMZN, from the WL breached its trend line on the OR. The OR closed below the trend line so I decided to short as soon as the OR was taken out. My stop was S1, partial at S2 and close at support (blue line). Sweet.

AMZN, from the WL breached its trend line on the OR. The OR closed below the trend line so I decided to short as soon as the OR was taken out. My stop was S1, partial at S2 and close at support (blue line). Sweet. GARM took out yesterday's gap down support on the OR, but I was too busy with AMZN. Luckily it found support at S2 and carved out a beautiful, dummy bear flag with 2 NRIBs (NR7 trigger bar). Partial out on breach of hammer high. Watch S2 for potential reversal. S2 holds on a closing basis. I had a target of $45.00 based on long term support. Close enough.

GARM took out yesterday's gap down support on the OR, but I was too busy with AMZN. Luckily it found support at S2 and carved out a beautiful, dummy bear flag with 2 NRIBs (NR7 trigger bar). Partial out on breach of hammer high. Watch S2 for potential reversal. S2 holds on a closing basis. I had a target of $45.00 based on long term support. Close enough. ACI won't go down. Dummy flag on 5 minute. Support at $51.00 breached but Crude inventories out at 10:30 were surprising on the low side triggering a swift reversal.

ACI won't go down. Dummy flag on 5 minute. Support at $51.00 breached but Crude inventories out at 10:30 were surprising on the low side triggering a swift reversal.

11 comments:

Very nice explanations on all of your trades. Very insightful.

Can you just explain on the GRMN trade why in that case NRIB's on low volume were considering bearish instead of bullish. It almost looks like its setting up for a break of Support on the upside with the NRIB NR7.

Could you also dedicate a post to explaining bullish/bearish flags?

Thanks Anon,

The NRIBs are neutral in that they are doji sticks, however there are a few tells that they are going to break to the downside, including pressure from the down sloping 5 period ema and declining volume on the flag pattern. You can't go wrong by putting your sell stop order just below the previous bar low for bars that touch the line. As each bar completes itself, move the sell stop just below the next higher bar. Inside bars on declining volume imply price and volume contraction ahead of expansion, so in the context of a flag, it's like a coiled spring.

I like the AMZN trendline trade!

Cheers,

Thanks Anarco,

I've been drawing trend lines on most of my WL stocks. It gives a better perspective especially for stocks gapping down after such an extended uptrend.

Nice Trade on AMZN :)

Thanks Dave,

Mapping out the charts ahead of time, and setting alerts, makes trading a little easier.

Jamie,

You commented above "You can't go wrong by putting your sell stop order just below the previous bar low for bars that touch the line".

Can you clarify what you mean by bars that touch the line? What line are you referring to? Thanks

YR

YR,

I'm referring to the bear flag line that I drew on the GRMN chart. I will do a post on flags to describe in more detail.

Also read my last RIMM post with a small bear flag midway through the down move.

Thanks for your explanations.

So you are saying price and volume contraction just imply expansion but they do not imply the direction of the expansion. To determine which direction one should use other indications such as MA's, PP or patterns.

Is this correct? Thanks!

On the GRMN trade how did you manage your stop after you partialed out on the hammer break?

Did you have a stop at S2? Im guessing not since you would have been stopped out. Or did you have a mental stop in mind? From your post it seems like the criteria to exit would have been a close above S2. Is that correct?

Anon,

That is correct re: price contraction leading to expansion.

Re: managing stop on GRMN, if the whole $ number is close give it an extra 5-10 cents. Price has an uncanny way of gravitating to the whole number and then reversing.

Post a Comment