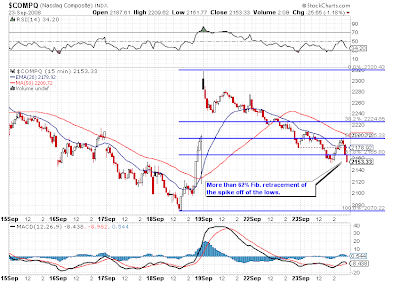

The prevailing short -term bearish trend is intact as we can see from the 15 min. chart. Cautious trading during Paulson/Bernanke testimony to the Senate regarding the bailout (did you notice that Bernanke looked and sounded very nervous).

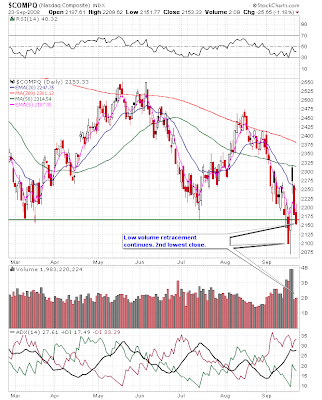

The prevailing short -term bearish trend is intact as we can see from the 15 min. chart. Cautious trading during Paulson/Bernanke testimony to the Senate regarding the bailout (did you notice that Bernanke looked and sounded very nervous).As I mentioned in the previous post, sideways trade after an extensive slide is more typically a continuation pattern (pause in prevailing short term trend not a reversal). Either the market was disappointed as the testimony/Q&A unfolded or the ban on shorting is having a reverse psychological effect. Either way, we had another downside breakout and new lows. We also experienced a solid turnaround off of the afternoon lows but gave it all back in the last hour to close on the lows of the day. Sectors pacing the way lower included: Coal, Housing, Mining, Oil Service, Steel, Casino, Chemical. Strength was pretty much limited to Airlines.

After hours Goldman (GS) and Buffett strike a deal. For Goldman, Buffett's endorsement came at a price. Berkshire Hathaway Inc., is buying $5 billion of perpetual preferred stock with a 10 percent dividend. Berkshire also gets warrants to buy $5 billion of common stock at $115 a share at any time in the next five years. The common stock closed after hours at $134.75, so if my math is correct, Buffett has an instant paper profit of $858 million!

Economic calendar: existing home sales at 10:00 and crude inventories at 10:35

No comments:

Post a Comment