The first chart is the weekly time frame for the S&P. The key takeaway here is the technical bounce at the 50% Fib. retracement level of the 2002 lows to the Oct. 2007 highs. We bounced from the 38% level and now we bounce again at the 50%. Is this a bottom? Not sure, but we'll need to see continuation on high volume.

The first chart is the weekly time frame for the S&P. The key takeaway here is the technical bounce at the 50% Fib. retracement level of the 2002 lows to the Oct. 2007 highs. We bounced from the 38% level and now we bounce again at the 50%. Is this a bottom? Not sure, but we'll need to see continuation on high volume.

The VIX topping candle foreshadows at retracement.

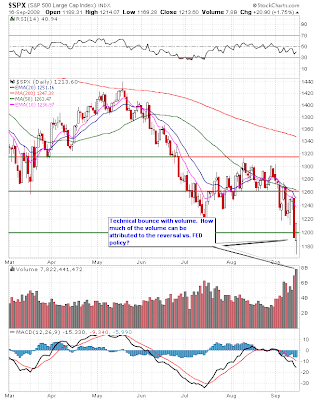

The VIX topping candle foreshadows at retracement. The NASDAQ breached supports on the gap open, but managed a strong bullish engulfing bar with big volume. My only concern about the volume, is that it is largely due to the post FED rally as we can see from the QQQQ chart below.

The NASDAQ breached supports on the gap open, but managed a strong bullish engulfing bar with big volume. My only concern about the volume, is that it is largely due to the post FED rally as we can see from the QQQQ chart below. Economic Calendar: Housing starts and building permits in pre-markets and crude at 10:35

Economic Calendar: Housing starts and building permits in pre-markets and crude at 10:35AIG bridge loan announced this evening - Over the weekend, AIG, pleaded with the FED to provide a $40 billion bridge loan to stave off a crippling downgrade of its credit ratings as a result of tens of billions of dollars of losses related to insurance investments that have turned sour. The FED rebuffed, and now two days later, it's going to cost them at least twice as much. Time is money - way to go guys!

No comments:

Post a Comment