The market is trading in a box and whipsaw was the theme of the last three sessions. No need to trade until the box is broken. Hard to make money on non-trending days.

The market is trading in a box and whipsaw was the theme of the last three sessions. No need to trade until the box is broken. Hard to make money on non-trending days.After three consecutive lower closes on the weekly, I favor a pause or snap back rally. But the markets are jittery and highly sensitive to the news and earnings of the day. Stay nimble.

Agchem also a box play. Looks and feels like it wants to make a move towards the base. A lower USD would help this sector. I favor POT as the move is in play with Friday's breach of the $74 pivot.

Agchem also a box play. Looks and feels like it wants to make a move towards the base. A lower USD would help this sector. I favor POT as the move is in play with Friday's breach of the $74 pivot.

Gold is strong, but needs to consolidate the big move.

Gold is strong, but needs to consolidate the big move. USD will retrace or reverse. $CAD already made a big move Thurs. & Fri. against the greenback.

USD will retrace or reverse. $CAD already made a big move Thurs. & Fri. against the greenback. Oil looks ready to move higher out of a well shaped H&S bottom. Keep some oil names on the focus list. I'm watching CNQ, ECA, SU, OXY.

Oil looks ready to move higher out of a well shaped H&S bottom. Keep some oil names on the focus list. I'm watching CNQ, ECA, SU, OXY. Financials are consolidating after a retest of the Nov. lows. Lots of charts looks like BAC below. If this breaks to the upside, it could be a sizable move. Keep a few names on the focus list and get ready to jump in.

Financials are consolidating after a retest of the Nov. lows. Lots of charts looks like BAC below. If this breaks to the upside, it could be a sizable move. Keep a few names on the focus list and get ready to jump in.

Click on charts to enlarge and read comments.

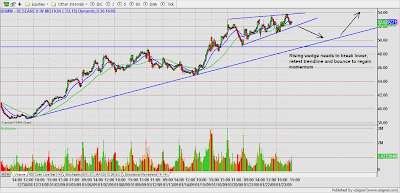

SNDK daily and RIMM 15 min. I like the strength in these two names if tech can do something this week. SNDK in play as long as the trendline holds as support.

SNDK daily and RIMM 15 min. I like the strength in these two names if tech can do something this week. SNDK in play as long as the trendline holds as support.

10 comments:

great blog Jaime...

I agree that the dollar looks bullish however some topping candles have appeared in the range of the consolidation indicating that a temporary pullback may be in order. On the flip side gold looks to have painted a potential buying climax that would seem to respect the weekly down-trend line that is still in play. I'm starting to wonder if these two will move down together as they have moved up together. Dollar strength seems to be legitimate risk aversion however gold prices seem irrationally and emotionally high as indicated by stock prices within the gold industry.

Volume of the oil ETF's indicate that some type of accumulation is occurring. The head and shoulders price-action pattern also confirms this. I think the question is whether or not that leads to a sizable price rebound or a weak bear market bounce. Softs look like they may be thinking about another down leg and this wouldn't bode well for any substantial oil rebound. Any sizable rebound could potentially draw major selling pressure to liquidate and short as we appear to be in the wrong phase of the cycle for legitimate commodity price appreciation. Having said that, Oil looks to be getting ripe for a swing trade to the long side.

The XLF continues to scallop lower. However the recent down leg could potentially be considered a successful test of November low. This selling leg produced less volume and the four candles included in the bullish box setup could be considered a throw-over to the downside. A close above the box is a buy signal, not only because it closed above the box, but also because it would be the first close about the low of the red selling climax candle from November. This would confirm a throw-over and potentially lead to a partial retracement of the down-leg.

Sandisk had a nice selling climax in mid-October that produced the gap that is currently in play. Mid-November showed us that the market was sold-out of Sandisk and should move higher. A strong bull candle in the beginning of December prints strength on the chart and tells us the issue has moved too low. A pullback occurs on light volume that leads to a light volume new year rally. However, with participation in the second up leg lagging participation in the first up leg, Sandisk appears to facing formidable resistance at the the top of the gap. Participation already withdrew on the first attempt to test this level. However, the fact that this holiday leg didn't completely retrace (yet) indicates that at least one more run at the area could be in the cards. One thing is for sure, participation will have to appear in convincing fashion or else this third attempt will produce a truncated leg and form a potential double top. A close below the 11-ish level is a sell signal as concerns still remain about Sandisk breaking into that gap on holiday volume.

One more piece of evidence supporting a short term bullish bias is the W pattern seen in the European markets on Friday (especially in the DAX). However, this market is very news and earnings driven right now, so we still have to be flexible and not develop a strong opinion.

Hey Lars,

Welcome back. Hope the surgery was successful. Thanks for all the helpful comments.

Markets are hard to read this week as we whipsaw in a narrow range. I'm looking for the clearest technical signals so that we can have areas to focus on in the coming days.

As far as SNDK is concerned the pattern is in play as long as it holds the trendline. The meltdown was primarily due to the failed buyout, but SNDK is still a leading innovator in flash memory. Their new SSDs are getting good reviews. So if the sector moves, this stock has a clear technical pattern and we can measure the move.

Rick,

Yeah, I see a perfect W pattern forming early afternoon and a nice rally that followed.

Agree cash is king unless we get more evidence.

Hey Jamie,

Great stuff. No doubt better than 9/10 subscription services.

Consistent with your market analysis, I am seeing some good range contraction (box play) candidates in my daily scans. Some top candidates are: WYNN, LEAP, NAV, NSC

BIDU and RIMM (which you mentioned) are not far down the list. BIDU can be difficult to trade, but is setting up (near 100) for some movement in the near future.

Thanks Jim,

I see a partially unfilled gap dating back to May 2006 between $65-68. Is that what you have in mind for BIDU? I also see lots of support at $60.00 including IPO.

Jamie,

On these range contraction (RC) plays, calling the BO & trend direction is ~50/50 game (for me anyway). On BIDU, my primary interest is in the 7 day RC within the 8-9 week descending triangle. I will simply look for range expansion and trade with it intraday. If I happen to catch a good entry and a solid BO - taking out 100 to the downside or the down sloping trendline to the upside - I might hold a partial for a bigger daily target. Downside support 92-93, then 68-70. Upside gap at 178, then 38% retrace back to 200ish. However, holding swing trades has been tough of late.

Jamie,

By the way, a great play on BIDU would be a head fake below 100 and a reversal back thru the triangular consolidation (daily) with a gap fill target at ~178.

Jim,

Thanks for the insights. The reason I asked is that BIDU really looks choppy intraday. One of my criteria after running these scans is to look for orderly price action leading into the BO on the 15 min. timeframe. So I would be favoring LEAP, WYNN and RIMM short-term.

Roger that - good advice.

Post a Comment