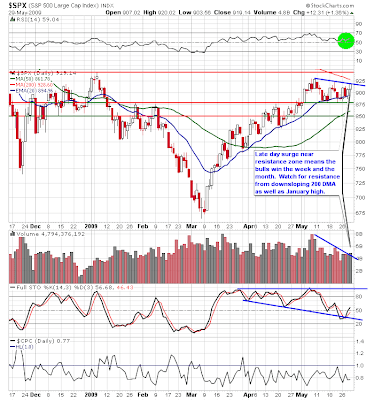

Most of Friday's session was choppy in the wake of mixed economic data. However, a late day rally in the last half hour pushed the S&P to fresh highs for the week. The rally seemed contrived but I'm not going to fight the tape. That said, we need to focus on key levels going into next week - Most recent high 924; May high/ 200 DMA 929/930; January closing high 934; and finally, January high 943.

Most of Friday's session was choppy in the wake of mixed economic data. However, a late day rally in the last half hour pushed the S&P to fresh highs for the week. The rally seemed contrived but I'm not going to fight the tape. That said, we need to focus on key levels going into next week - Most recent high 924; May high/ 200 DMA 929/930; January closing high 934; and finally, January high 943.Normally, we see new institutional money being put to work in the first week of the new month, but this rally is three months old and testing significant resistance, so I would not be initiating any new long position trades at this late date.

Keep a close watch on economic data, especially employment data later in the week. Economic Calendar for June 1 - June 5th

$USD breaches minor support level as $CAD approaches resistance.

$USD breaches minor support level as $CAD approaches resistance.

Focus List of Stocks:

CME - dragonfly doji after a big run up in price could signal bears are getting ready to take over.

CME - dragonfly doji after a big run up in price could signal bears are getting ready to take over. FSLR could retest $200 this week.

FSLR could retest $200 this week. ENER - solar laggard could be setting up to join the rally.

ENER - solar laggard could be setting up to join the rally. GIL - Bullish flag pattern

GIL - Bullish flag pattern AMZN - coiling as MAs converge

AMZN - coiling as MAs converge AMGN attempting to save itself, but either way there's a trade setting up here.

AMGN attempting to save itself, but either way there's a trade setting up here. WFC - may get one last pop before we retrace.

WFC - may get one last pop before we retrace.

10 comments:

Hi Jamie,

Been an avid reader of your blog for almost a year now since I started learning how to trade. Everyday, I log in to your blog more than 10x a day to learn from you. And this is the first time you offer some stocks that are of interest to trade. You're such a nice guy to offer your knowledge/ideas without any reservation. It keeps us motivated (like me who is starting to be a trader from zilch) who are struggling in learning/how to find a good trade. Thanks a lot Jamie.

Hey DJ,

I used to post focus lists more often in the early years of the blog. Lately, I've been putting more emphasis on the markets/sector TA as opposed to individual stock analysis. I will try to post a focus list once a week to mix it up a bit.

Thanks for the feedback.

Re WFC: Sounds like you think that any pop out of the desc triangle might end-up being a head fake ...Why?

I happen to be swinging short on WFC.

John,

I think we may pop higher, but it should be short lived. The first two months of the rally we had the wind at our backs. Now, we are trading into the wind and we have to be more nimble as this thing will likely end soon. Maybe you can average up on the WFC trade if you need to, but Financials will likely play a leading role in the upcoming correction.

Test on January highs on S&P and $USD catching a bid are two technical levels I am watching closely. If USD bounces, the commodity led rally will end.

AMZN - coiling as MAs converge

What is the importance of MAs converge in general and iin AMZN case?

Hi Jamie,

Thanks for posting the focus list. It really helps newbie like me to read daily charts. I have another request. It will be very nice if you can post your swing trades charts at times. I just want to learn why& where you entered and exited. I have just started to read a little about swing trading and also ordered Alan Farley's Swing trading book this weekend. I know it's asking for too much from you when you already give so much time and effort to your blog and readers.

Thanks,

Day Tradr

GPT,

I answered your question in the AMZN day trade post above. The examples above are for swing trades, but you can also apply this coiling/convergence concept to day trades.

Day Tradr,

The best swing trading strategy I've come across is Market Club's Trade Triangles (side panel). Using the weekly timeframe to trigger a buy or sell and then picking your spot on the daily.

Most of my swing trades are Canadian stocks. I also gamble with mad money on biotech PDUFA dates. The latter is not something I want to encourage here because it's too risky.

I have no swings at the moment. I was stopped out on ABX today. Target of $40.00 not reached and stop hit when price took out PDL.

I will post more focus lists and we can discuss potential swings in the future, but the main focus is day trading.

There's a good chapter on coiling in the Farley book.

Thanks Jamie.

I was wondering if there any any scans that can scan for MA converge candidates?

What are your thoughts on FSLR? It touched it's gap support the third time today on daily.

Thanks,

Day Tradr

Day Tradr,

MA convergence often occurs within a triangle pattern.

FSLR could be forming a huge bearish island reversal if it gaps down out of the base, but after three consecutive lower closes, I'd like to see it consolidate before breaking lower, otherwise it could be a head fake. Keep an eye on it.

AMZN looks to be breaking out of multi month base, but here again we have three consec. higher closes.

Post a Comment