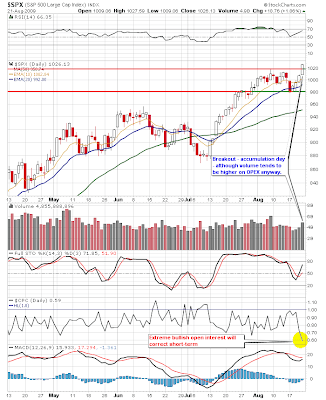

The market staged a technical breakout on better than expected Existing Home sales and a positive economic assessment from the Fed Chair. Narrow range trade at range highs dominated for several hours before a later afternoon push to a fresh session high. The upside extension allowed all the market indices to establish new 2009 close/intraday highs.

However, that left the CPC way too bullish and prices are popping well above trend channels. Futures are higher as I write this post. Target S&P 1050 on this last thrust. I see resistance there and the smart money is likely to takes profits which will result in a much needed correction back to the trendline.

V forming a cup & handle.

V forming a cup & handle.

2 comments:

Nice analyis Jamie! Been in my focus list V all the time and good to point out the formation. I'll keep an eye on it.

Thanks GD,

V and MA were gap fades on early strength this morning. We'll see how things develop as price/volume contracts intraday.

Post a Comment