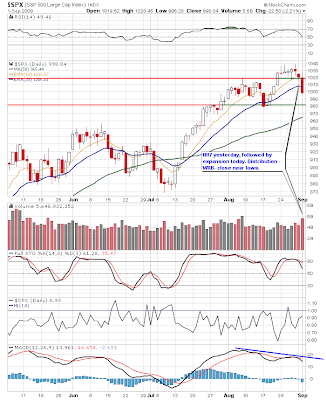

Yesterday's NR7 was a perfect foreshadowing of today's expansion. Despite the stellar ISM and pending home sales data, the bears easily took control of the session and held into the close. Financials paced the way lower amid rumors, along with commodities/energy on a stronger $

USD.

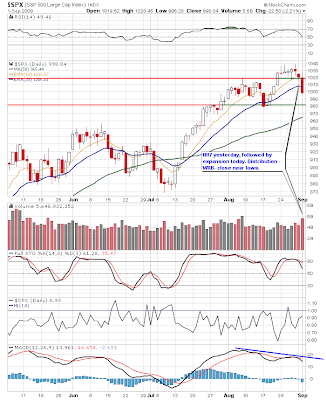

The tail end of the range bound market was difficult to trade. One strategy that worked well was buying/selling a head fake lower/higher. Using

PDH/L as trigger points, look for reversal candlestick patterns shortly after trigger point has been breached - ideally this happens in the first/last hour of the trading session when volatility is highest.

Yesterday's NR7 was a perfect foreshadowing of today's expansion. Despite the stellar ISM and pending home sales data, the bears easily took control of the session and held into the close. Financials paced the way lower amid rumors, along with commodities/energy on a stronger $USD.

Yesterday's NR7 was a perfect foreshadowing of today's expansion. Despite the stellar ISM and pending home sales data, the bears easily took control of the session and held into the close. Financials paced the way lower amid rumors, along with commodities/energy on a stronger $USD.

The tail end of the range bound market was difficult to trade. One strategy that worked well was buying/selling a head fake lower/higher. Using PDH/L as trigger points, look for reversal candlestick patterns shortly after trigger point has been breached - ideally this happens in the first/last hour of the trading session when volatility is highest.

The tail end of the range bound market was difficult to trade. One strategy that worked well was buying/selling a head fake lower/higher. Using PDH/L as trigger points, look for reversal candlestick patterns shortly after trigger point has been breached - ideally this happens in the first/last hour of the trading session when volatility is highest.

7 comments:

Jamie:

I took a similar trade in AAPL today when it hesitated at 170 forming lower high. I closed the position very quickly (without any reason :() before it reached ORL. Is there any way to set any initial target for these type of setups?

Hi, I am currently working part time for an advertising company to source for advertising space on finance blogs. I have recommended your site to my company.

We have taken a keen interest on it. Are you interested to let them place advertisments on your blog? We will pay you the fees upfront, into your paypal account in USD. A sample of their advertisement (CFDs investing) has been placed on my blog (http://sgbluechip.blogspot.com/) and no clicks or minimum impressions are required.

Blogs with our ads:

http://sgmusicwhiz.blogspot.com/

http://www.investmentmoats.com/

http://fivecentstencents.com/blog/

http://ghchua.blogspot.com/

http://ntuchartist.blogspot.com/

http://market-uncle.blogspot.com/

http://level13-analysis.blogspot.com/

http://bullythebear.blogspot.com/

Do let me know if you are keen and we can discuss the rates over emails. No meeting or tele conversation is required. Please email me at sgbluechip@gmail.com

Please quote your blog address when you email me. I will reply asap!

Hi Jamie,

Nice trades! Just wondering on your head fake trades...where do you put your stop? I'm guessing you're using the prev candle as a stop? Thanks.

Day Tradr,

AAPL was a gap fill (Fri. - Mon.) so it's always a good idea to lock some in on the fill, because price usually pauses to consolidate at that level as most trader's are exiting the trade.

Thanks JTT,

I set stops at previous bar high/low plus a couple of cents. If the trigger bar is an inside bar, I set the stop above/below outside bar.

Thanks Jamie, One last question for you about this one....Are you using the prev bar on the 15min timeframe or are you dropping down to the 5min timeframe so that you get a tighter stop when price breaks the trigger point. Ok maybe one more question:) How long (months/years?) did it take you to be able to sit back and digest what the market was doing so you could be so adaptable in your trade ideas? You seem so intune with the market. I've been daytrading 1 year and still finetuning to get out of break even mode! Thanks and Happy Trading!

JTT,

I prefer to set stops based on 15 min. timeframe because I don't like getting stopped out and then seeing the trade take off without me. However, if the trade goes in my favor and then makes a reversal pattern, I won't hesitate to scratch the trade.

My learning curve for consistent and confident day trading results was approx. 3 years. My knowledge of the markets and intermarket relationships is still developing.

Post a Comment