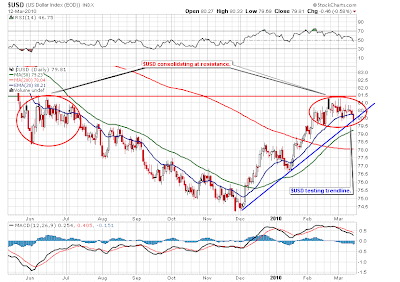

New 52 week highs in early trade following retail sales data, but Michigan sentiment was below consensus and prices retraced, spending the rest of the session in a sideways chop. As we can see from the above chart, prices are testing resistance and a period on consolidation would be healthy at this point.

New 52 week highs in early trade following retail sales data, but Michigan sentiment was below consensus and prices retraced, spending the rest of the session in a sideways chop. As we can see from the above chart, prices are testing resistance and a period on consolidation would be healthy at this point.The $USD succumbed to weakness Friday, finally closing on the trendline.

POT gapped into resistance on guidance. We have a volume spike which should lead to a swing long as soon as prices consolidate the move.

POT gapped into resistance on guidance. We have a volume spike which should lead to a swing long as soon as prices consolidate the move. CLF gapped after JPM raised their target price to $83.00. I set a buy stop order just above the pre-market high. Resistance at $65.00 so I'm going to wait for a pullback or consolidation before swinging long.

CLF gapped after JPM raised their target price to $83.00. I set a buy stop order just above the pre-market high. Resistance at $65.00 so I'm going to wait for a pullback or consolidation before swinging long.

No comments:

Post a Comment