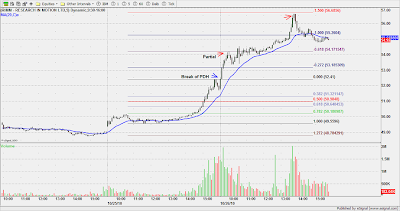

As noted yesterday, RIMM had broken out of a multi-month base. Today, I placed a buy stop order above yesterday's high. Took a partial at the 62% Fib. extension. The balance ran up to 150%. The last 50% of the move was euphoric as we can see from the volume.

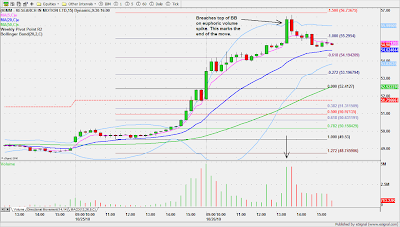

As noted yesterday, RIMM had broken out of a multi-month base. Today, I placed a buy stop order above yesterday's high. Took a partial at the 62% Fib. extension. The balance ran up to 150%. The last 50% of the move was euphoric as we can see from the volume.On the 15 minute timeframe below, we see that RIMM breached the top of the upper BB on a euphoric volume spike, marking the end of the move. Like capitulation, this is a tradable reversal setup.

NFLX and MOS were HCPG picks from last night's newsletter. I wasn't in love with the NFLX setup until it printed a NRIB - NR7, one of my favorite entry points. Price/volume contraction ahead of expansion.

NFLX and MOS were HCPG picks from last night's newsletter. I wasn't in love with the NFLX setup until it printed a NRIB - NR7, one of my favorite entry points. Price/volume contraction ahead of expansion.MOS was entered on the pullback.

8 comments:

Hey Jamie,

I figured you caught the same entry as me on NFLX today.

Your FFIV trade, would you consider that an ambush setup?

Ken

What's on your WL for tomorrow?

Hey Ken,

Yeah, the FFIV trade is an ambush on the shorter timeframe.

M,

I'm focusing on earnings gaps such as BRCM, FFIV and sympathy plays like AKAM, EQIX, RVBD. Also, looking at $USD strength and its effect on commodity plays like steel CLF, X. Also, focusing on RIMM, ISRG, SOHU, NFLX,IBM, SNDK plus the HCPG trading list.

Jamie,

Have you noticed a difference in price patterns and trading setups now compared to a year or two ago?

It seems to me that trend days are far and few in between while the quick scalp is much more common and frequent now for success.

also, do you notice if its been more difficult to day trade in general?

James,

Yeah, 2008 and 2009 were some of the best trading years in my day trading career thus far. During the crash ATR peaked around 7 and during the recovery around 3. Now, ATR for the SPY is tracking at 1.45.

The lower ATR means we have to work harder to find the momentum stocks.

Hi Jamie,

Thanks alot for your last reply.

May I ask where you put the initial stop when you long on the break of PDH in the trade of RIMM(10/26)? When your order was executed, you may have no idea what kind of the first 15min bar like. Maybe it will close like a Shooting Star and start reverse. Why you have the confidence to pull the trigger instead of waiting for a consolidation? Thanks.

Regards

Dongbo

Post a Comment