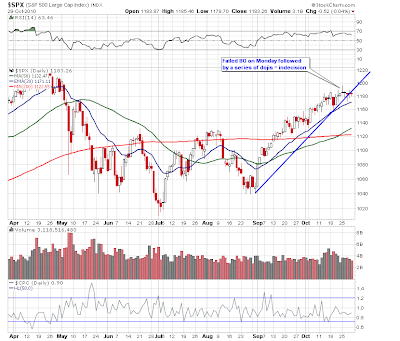

As we can see form the 15 minute chart of the SPY above, despite two attempts to BO, the week ended almost unchanged. We carved out a series of dojis on the daily, implying indecision. The Nasdaq continues to outperform. We note more distribution on the SPY, however, weakness continues to be bought. Therefore, we can't conclude anything bearish from this week's action.

As we can see form the 15 minute chart of the SPY above, despite two attempts to BO, the week ended almost unchanged. We carved out a series of dojis on the daily, implying indecision. The Nasdaq continues to outperform. We note more distribution on the SPY, however, weakness continues to be bought. Therefore, we can't conclude anything bearish from this week's action.Reaction to U.S. elections and FOMC policy statement will be interesting. Jobs data on Friday will no doubt be an important factor.

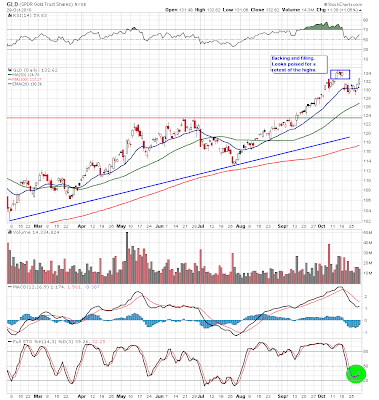

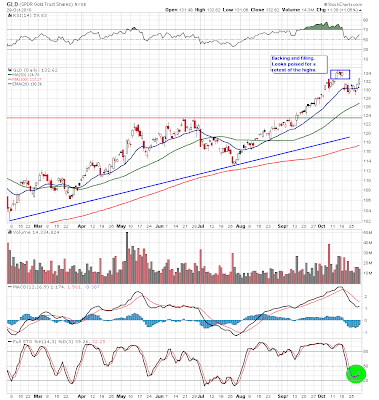

GLD looks bullish after some backing and filling. Weakness in the $USD will no doubt fuel a retest of the recent highs. Silver has already retested and broken out.

GLD looks bullish after some backing and filling. Weakness in the $USD will no doubt fuel a retest of the recent highs. Silver has already retested and broken out.

Some companies of interest reporting this week:

Monday: ACOR, AGN, BHI, CTSH, CTB, ICE, JKS, APC, ESLR, EXTR, WFR, NTRI, and VMC.

Tuesday: ADM, BP, CLX, COCO, K, NYX, CECO, CQB, ERTS, HTZ, LEAP, MYGN, TEVA, OPEN, STEC, and WYNN.

Wednesday: ANR, ASCA, CVS, GRMN, JRCC, MGM, TAP, Q, TWX, CELL, FRPT, ROCK, JCOM, QCOM, MELI, MUR, PRU, SWIR, THQI, WBMD, and WFMI.

Thursday: APA, BDX, CVC, CBOE, CCOI, DTV, RAIL, PCS, ZEUS, SMG, TWC, UPL, USM, WWE, AMLN, BEBE, NILE, CEDC, CF, FLR, FTEK, HANS, JDSU, MCHP, SBUX, and SVNT.

Friday: BZH, BAM, CEP, DISH, SATS, FIG, FWLT, FCN, NVAX, PXP, SOL, and YRCW.

Tuesday: ADM, BP, CLX, COCO, K, NYX, CECO, CQB, ERTS, HTZ, LEAP, MYGN, TEVA, OPEN, STEC, and WYNN.

Wednesday: ANR, ASCA, CVS, GRMN, JRCC, MGM, TAP, Q, TWX, CELL, FRPT, ROCK, JCOM, QCOM, MELI, MUR, PRU, SWIR, THQI, WBMD, and WFMI.

Thursday: APA, BDX, CVC, CBOE, CCOI, DTV, RAIL, PCS, ZEUS, SMG, TWC, UPL, USM, WWE, AMLN, BEBE, NILE, CEDC, CF, FLR, FTEK, HANS, JDSU, MCHP, SBUX, and SVNT.

Friday: BZH, BAM, CEP, DISH, SATS, FIG, FWLT, FCN, NVAX, PXP, SOL, and YRCW.

GLD looks bullish after some backing and filling. Weakness in the $USD will no doubt fuel a retest of the recent highs. Silver has already retested and broken out.

GLD looks bullish after some backing and filling. Weakness in the $USD will no doubt fuel a retest of the recent highs. Silver has already retested and broken out.

4 comments:

Hey Jamie,

Love your blog, and trying to learn to trade full time. Had FFIV on the watchlist on Friday. Setup on 15min timeframe, inside bar right on 5ema for 2nd candle. Took a long above high of 2nd bar in anticipation of breakout on daily.

It did breakout but then reversed. Would you have taken this trade or am I missing something that would have warned me that this may not be a legit breakout.

Thanks,

Dizzles

Hi Jamie,

Thanks for your great posts.

I am reading your post on Oct.26. You said you “wasn't in love with the NFLX setup until it printed a NRIB - NR7”. May I ask the reason? The 1st is WRB. The 2nd and 4th are NRB in upper range of ORB with higher lows. I would like to long on the break of 5th Bar. I often trade this kind of pattern. But the winning% is not high. Could you please give me some suggestions? Thanks alot.

Best wishes

Dongbo

Hey Dizzles,

The FFIV trade was a perfectly good setup. I was in it myself. Price rallied and stalled just shy of the $120.00 round number. That was a good time to start booking some profit. When it failed to hold previous high from Wed. it was time to fold, because former resistance is supposed to hold as support. If it doesn't hold, it is a failed BO. Failures often lead to fast moves in the opposite direction, so it is best to get out and wait for price to find support.

Hi DW,

The problem with NFLX is that mistakes are costly. The NRBs are $1.00+, so I want a near perfect setup. I was hoping for a NR green bar that closed at or near the ORH. That's why I waited.

The Break of 5th bar high is a good setup as long as you use the lowest low as your stop because the stock is still range bound until it can lift and close above the ORH.

If you look at the setup on a 1 minute chart, it's easier to see that price is just chopping around between $170.50 and $172.35. Price crosses above and below the MAs, until it forms a handle above the MAs. That handle on the 1 min. is my NRIB NR7 on the 15 min.

Post a Comment