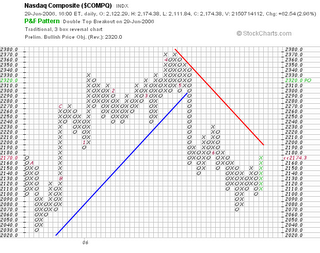

Today's rally resulted in a double top P&F breakout with a new preliminary bullish target of 2320 from today's close of 2174.

Today's rally resulted in a double top P&F breakout with a new preliminary bullish target of 2320 from today's close of 2174. The entire session was bullish from this morning's gap up until noon. This was followed by a quiet period of sideways action leading into the much anticipated Fed announcement. But at 2:15 volume took off and so did price. There was no hesitation and the usual volatility following a Fed statement was not evident. Everything moved in the same direction in a very orderly fashion.

The entire session was bullish from this morning's gap up until noon. This was followed by a quiet period of sideways action leading into the much anticipated Fed announcement. But at 2:15 volume took off and so did price. There was no hesitation and the usual volatility following a Fed statement was not evident. Everything moved in the same direction in a very orderly fashion.The result was a wide range bar which lifted us out our three week trading range on higher volume. The NASDAQ added 62.5 points or 3% on the session. All tech sectors participated and several including the SOX and NWX added 4% on the day. Everything on my screen was green at the end of the session except PALM which reported disappointing earnings AH and is now trading below $17.00. RIMM, on the other hand, is testing $70 after a favorable earnings report. I mentioned in my Trade of the Day post that AAPL is also down AH on unusual stock option activity. It'll be interesting to see which names can hang on to these gains tomorrow. Be on the alert for early winners tomorrow morning as we may get some more quarter end window dressing.

1 comment:

PALM handily beat eps and revenue expectations and raised guidance but it wasn't as high as some analysts expectations so they got pummeled. The market can be brutal.

Post a Comment