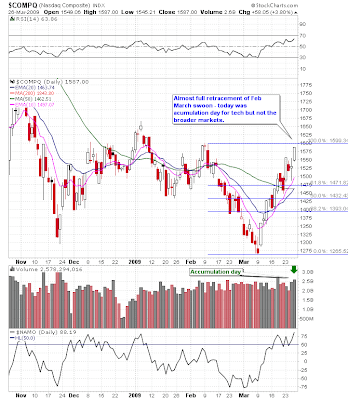

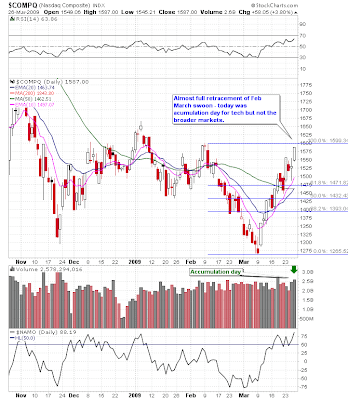

The markets closed near session highs following another broad based advance. The advance was helped along by earnings and a satisfactory treasury auction. Tech outperformed with solar leading, along with big tech names. Another accumulation day for the NASDAQ as prices near full

retracement of the Feb.- March slide. Financials held and printed a

NRIB (NR7) on the day. I see some C&H patterns forming on dailies in health/

biotech (HUM,

AMGN,

CEPH). Technicals are extended. I've added the McClellan Oscillator (NAMO) to the bottom of the Comp chart, and as indicated, we have an extreme overbought reading. As John mentioned in the comments, probably much of this is due to month/

QTR end window dressing given the exceptional bounce off of the lows.

The markets closed near session highs following another broad based advance. The advance was helped along by earnings and a satisfactory treasury auction. Tech outperformed with solar leading, along with big tech names. Another accumulation day for the NASDAQ as prices near full retracement of the Feb.- March slide. Financials held and printed a NRIB (NR7) on the day. I see some C&H patterns forming on dailies in health/biotech (HUM, AMGN, CEPH). Technicals are extended. I've added the McClellan Oscillator (NAMO) to the bottom of the Comp chart, and as indicated, we have an extreme overbought reading. As John mentioned in the comments, probably much of this is due to month/QTR end window dressing given the exceptional bounce off of the lows.

The markets closed near session highs following another broad based advance. The advance was helped along by earnings and a satisfactory treasury auction. Tech outperformed with solar leading, along with big tech names. Another accumulation day for the NASDAQ as prices near full retracement of the Feb.- March slide. Financials held and printed a NRIB (NR7) on the day. I see some C&H patterns forming on dailies in health/biotech (HUM, AMGN, CEPH). Technicals are extended. I've added the McClellan Oscillator (NAMO) to the bottom of the Comp chart, and as indicated, we have an extreme overbought reading. As John mentioned in the comments, probably much of this is due to month/QTR end window dressing given the exceptional bounce off of the lows.

2 comments:

Hi,

I believe the S&P could close near 880. That seems realistic to me as great resistance. This could give another 7% gain and go along a scenario I have posted on my blog on the CAC40 (French Index).

http://guillouj.blogspot.com/2009/03/cac-40-comparative-approach-with-bx4.html

What do you think?

--- ------

Jonathan

http://guillouj.blogspot.com/

Yeah, I see resistance in the 875-880 area. Potential for multi-week consolidation in the 800-880 zone. But I wouldn't short unless breaks below 800 on heavy volume.

Post a Comment