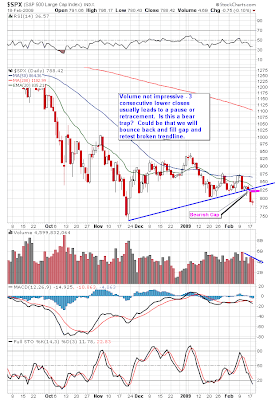

The doji sticks on the DOW and S&P imply a loss of momentum but we need to close above doji highs to confirm a retracement. The fact that the DOW is testing November lows and that neither S&P and NASDAQ are confirming, leads me to think that we may be in a bear trap. Clearly volume is not overly bearish.

The doji sticks on the DOW and S&P imply a loss of momentum but we need to close above doji highs to confirm a retracement. The fact that the DOW is testing November lows and that neither S&P and NASDAQ are confirming, leads me to think that we may be in a bear trap. Clearly volume is not overly bearish.You may have noticed that the afternoon session was rather choppy. That's OPEX (options expiration - 3rd Friday of the month) kicking in. And we may get more chop tomorrow.

Look for orderly setups like the inverse H&S pattern on the POT chart below. Don't get stuck in a choppy trade if you can help it.

No comments:

Post a Comment